DYNAMIC DEBT COLLECTION STRATEGY

PERSUASIVE

NEGOTIATIONS

Along with a vast understanding of the collection industry, each of our professional negotiators has over 10 years of debt resolution experience utilized to encourage your customers to a pre-suit resolution saving you time, money and resources in litigation.

PROFESSIONAL

SERVICES

Your satisfaction is our priority. As such we provide you with the best collection service in the industry at the fairest, and most competitive, contingent-based fee structure.

PERSISTENT

STRATEGY

Giving you the service and attention you deserve while producing a higher than expected rate of recovery separates us from our competition.

Persistent Strategy

Develop a communication strategy to help you negotiate more successfully.

Persistent Strategy

Develop a communication strategy to help you negotiate more successfully.

Persistent Strategy

Develop a communication strategy to help you negotiate more successfully.

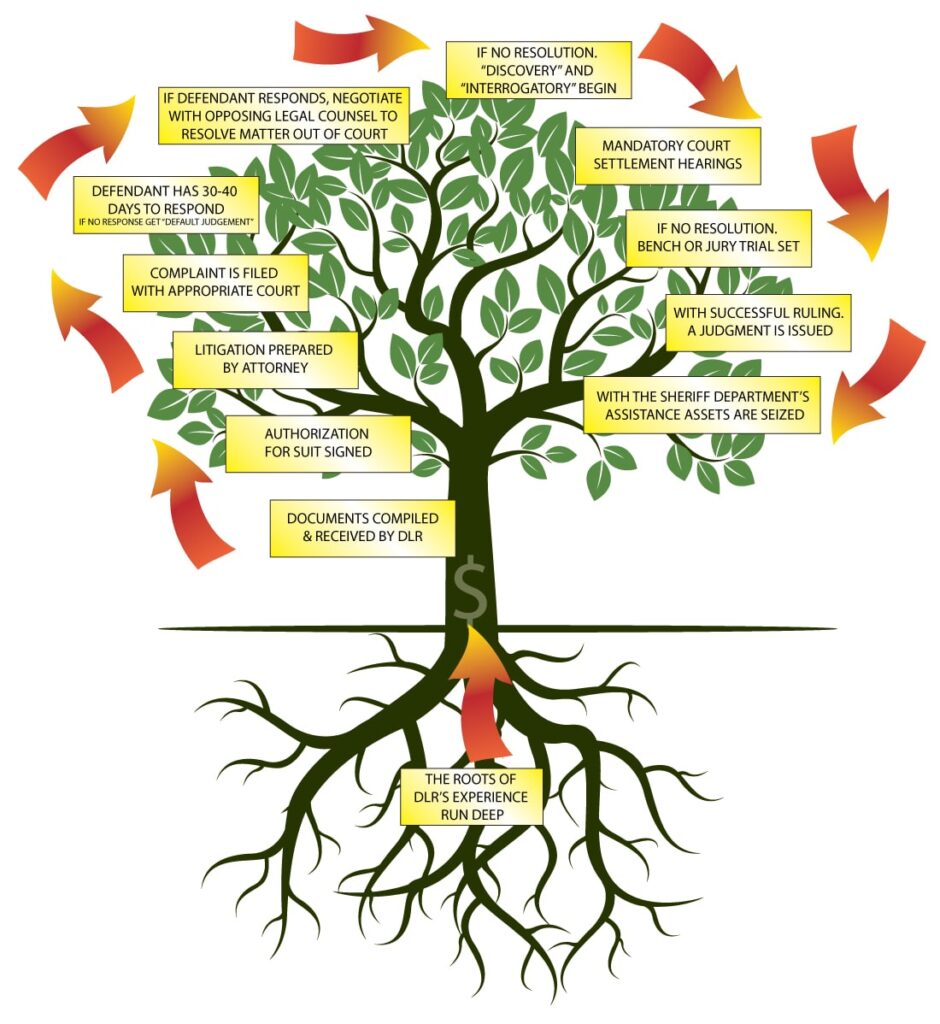

Anatomy of a Lawsuit

SUPPORTING DOCUMENTS

~KEYS TO SUCCESS~

- contracts you have signed;

- any credit application and/or personal guarantees;

- all invoices or statements of account showing payment and charges;

- proof of delivery, and any other documentation proving merchandise was received;

- any disputes from your customer;

DYNAMIC LEGAL RECOVERY IS NOT JUST A COLLECTION AGENCY. WE ARE A COLLECTION FIRM WITH AFFILIATE LOCAL ATTORNEYS IN EACH STATE.

It is true that most debtors hate collection agencies, but a savvy one knows that a collection agency has to take the final step of actually hiring an attorney before they can apply force. It is an attorney that unleashes the sheriff with the badge who can empty their bank account and get you paid. Thus, it is an attorney that a debtor truly fears.

We make every attempt to recovery your money without filing a law suit, if your customer will not cooperate by collection means alone, we are prepared to go through the litigation process on your behalf.

The primary part, and one of the most important factors, in a successful lawsuit is obtaining corroborating paperwork and documents that support your claim. These include contracts you have signed, any credit application and/or personal guarantees, all invoices or statements of account showing payments and charges, proof of delivery, and any other documentation proving merchandise was received, along with any disputes from your customer.

Once all of the documents have been received by our office and an authorization for suit is signed, your case is sent to an attorney to begin litigation. A summons and complaint is then prepared and filed with the local court and served upon your customer.

In addition to open book, account stated, common counts, breach of oral or written contracts and conversion, an action our office often sues for is “fraud”.

The defendant will then have between 30 and 40 days to file a response or answer to the complaint. If there is no response filed, we can go back to the court and asked for a default judgment. Upon receipt of the default judgment we can execute on the judgment.

In some states pre-judgments are available. With pre-judgements, the debtor will get 21 day notice of hearing as long as there is no possible dispute in the account and all of the ducks are in the row.

If the defendant chooses to answer the complaint, we start negotiating with their legal counsel, when applicable, to see if there’s a way to resolve the matter.

If we cannot resolve the matter at this point, we will send out discovery asking the defendant a lot of questions about the relationship which puts them in a position of realizing that the debt is clearly owed. The opposing counsel has the opportunity to do the same to us and we have to answer the discovery which are often called interrogatories.

In addition, there will be mandatory court settlement hearings in attempts to settle the account with court supervision.

If that is not possible, the case will be set for a bench or jury trial. A bench trial is a trial by judge while a jury trial is a trial by jury. In most states only nine of 12 jurors have to be for or against you.

Once we have a successful ruling and judgment, we begin the process of attaching the debtor’s assets with the assistance of the Sheriff’s Department. These assets may be wages, business assets, bank accounts, property, automobiles, etc

Our Collection Process

Discuss Your Goals

Share your goals and accounts due details with our collection team members.

Complete Assignment Form

Tell us about your accounts via a simple assignment form and our collection team goes to work for you..

Collect Your Money

Incease Your Revenue & Collect 83% of Your Accounts normally within 2 Weeks. After all, it’s your money.

FREE Consultation

You may unsubscribe from these communications at any time. For more information on how to unsubscribe, our privacy practices, and how we are committed to protecting and respecting your privacy, please review our Privacy Policy. By clicking submit below, you consent to allow dlrfirm.com to store and process the personal information submitted above to provide you the content requested.